Kenko Health In Catch-22

Kenko Health provides healthcare financing services intended for better medical coverage. The company offers comprehensive plans focused on low monthly to cover expenses, including medicines, doctor fees, lab tests, mental health, dental care, and outpatient department hospital bills, providing customers with prepaid benefits and affordable healthcare plans.

About Kenko Health

For Mumbai-based Kenko Health, the future was always about insurance. The founders — Aniruddha Sen and Dhiraj Goel — launched Kenko HealthKenko Health Datalabs_in-article-icon in 2019 after spending more than two decades collectively in the sector.

The idea was to make health coverage more reasonable and healthcare more accessible through deeper insurance penetration. However, deprived of an insurance license from the Insurance Regulatory and Development Authority (IRDA), Kenko’s go-to-market plan was constructed around a quasi-insurance model.

But the goal was continuous insurance. Given the founders’ background and the large value creation opportunity in insurance, Kenko attracted the attention of major investors.

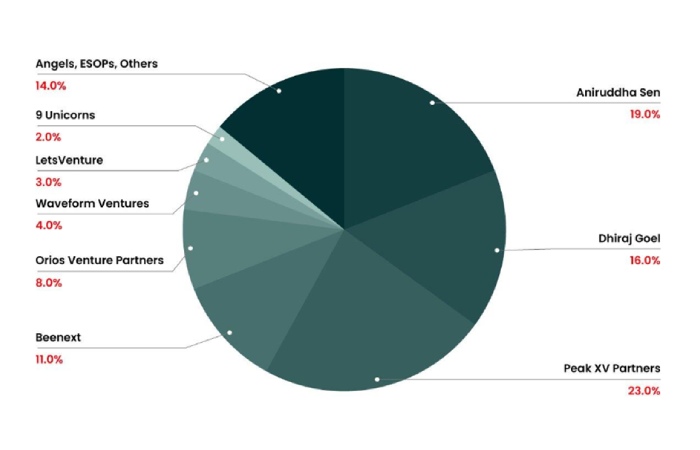

By early 2022, it had already raised more than $13 Mn from Peak XV Partners, Beenext, Orios Venture Partners, angel fund Waveform Ventures, accelerator 9 Unicorns, and the likes of Jupiter cofounder Jitendra Gupta, CRED founder Kunal Shah, Pine Labs CEO Amrish Rau as angel investors.

Buoyed by this capital, Kenko seemed to have cracked the revenue model for its consumer subscription-based health plans. This is a quasi-insurance product that covers outpatient department (OPD) benefits during hospitalization as well as medicine purchases.

As we see in its official filings, Kenko’s revenue grew from roughly INR 5 Cr in FY22 to INR 85 Cr in FY23 (17X growth), even though the net loss almost tripled to INR 68 Cr from INR 24 Cr in the previous year. But given that this was just the third full fiscal year in its lifetime, there were encouraging signs of growth.

Contact Information

Website

kenkohealth.in

Ownership Status

Privately Held (backing)

Financing Status

Formerly VC-backed

Primary Industry

Managed Care

Other Industries

Other Insurance

Vertical(s)

SaaS, InsurTech, HealthTech

Corporate Office

First Floor, F 285, Dreams The Mall Lbs Marg, Bhandup West Mumbai, Maharashtra 400078 India

Kenko Health Revenue Surges in FY23

Things couldn’t have looked better for the company when it was about to raise close to INR 220 Cr ($27 Mn+) in June 2023 from Healthquad, B Capital, Bertelsmann, and other large institutional funds, as indicated by its regulatory filings. Armed with this, the startup hoped to clear the insurance’s capital requirements threshold.

But this is also where things came undone for Kenko — not only did Series B not go through, but Kenko was left in a difficult Catch-22 position.

Right now, Kenko’s insurance goal is looking increasingly out of reach, according to sources close to the company’s shareholder group and founders.

However, discussions between the management and the existing shareholders have resulted in discord, Inc42 has learned over the past two months.

In particular, some shareholders are displeased with the restructuring proposal, which they believe leaves them with very little value for the capital already invested.

It must be noted that Peak XV Partners (investing as Sequoia Capital India & Southeast Asia) is Kenko’s lead external shareholder, having led its Series A round. Orios Venture Partners and Beenext follow Peak XV in terms of shareholding.

Focus Turns To Domestic Investors

Raising from Indian family offices sounds simple enough — HNIs and family-run corporations are increasingly looking to diversify their portfolio and back startups. HNIs and family offices also support large funds in India as limited partners. So, the regulator’s stipulation was not unusual.

Even in a tough market for fundraising, Kenko is said to have seen interest from two large family offices in India. One of them is still in talks with the company on how to proceed. According to the ET report on the state of Kenko, the company had received a term sheet from Hero Group.

Could not verify whether Hero Group had prepared a term sheet for the investment. However, the contours and structure of this deal have forced Kenko Health into a Catch-22.

Firstly, the incoming investor has to get the go-ahead from Kenko’s existing shareholders for the proposed new structure. Existing investors have to give approvals to their revised equity holdings.

In this case, Kenko Health had to restructure its entire cap table. Existing shareholders would have had to relinquish some stake in this restructuring and dilute equity in favor of any incoming investor.

Kenko Health Shareholding

On the shareholder side, only one investor responded to our questions but declined to comment.

Other sources close to the investor and management group at Kenko spoke to us on the condition of anonymity. The problem, we were informed, began roughly a year ago when the company had to rethink what investors it brings on.

Having to change its fundraising strategy in the middle of a key round in August 2023 was a major blow for Kenko. It had seen commitments from marquee investors such as B Capital, Healthquad, and Bertelsmann, and turning them down was never easy.

While there was real confidence about Kenko’s future because of the founders’ pedigree and the revenue growth, even the best of founders cannot adjust as quickly as Sen and Goel had to.

Another source, who has seen the company’s journey closely, added, “Getting a big commitment in the middle of a funding winter was not easy. Then, the company had to shift its focus to Indian investors, especially family offices or large corporations. The founders had to tell large VCs and investors to hold on.”

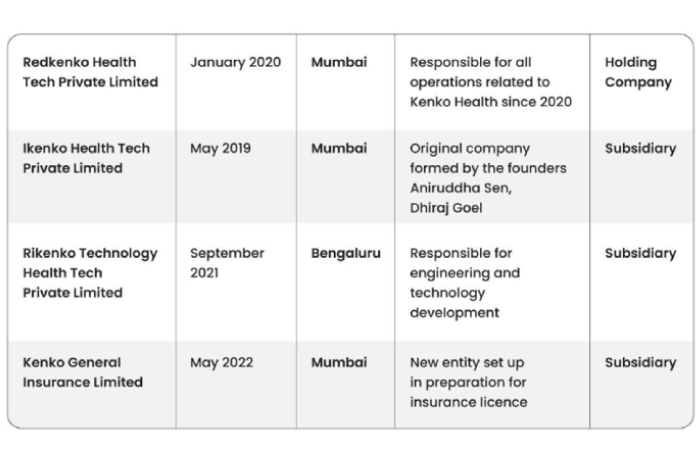

Beyond the need to bring in domestic investors, the corporate structure of Kenko also posed some problems, as the insurance business had to be run by a new entity, which was created only in 2022. In contrast, the parent company, Redkenko Health Tech Private Limited, handled the current operations since 2019.

Kenko’s Future Uninsured

At the moment, however, there is no certainty of any deal materializing. The founders are still in talks with domestic family offices for a deal that works for all parties involved.

Kenko Health has to swallow a bitter pill if these talks fail to materialise into an investment. The company laid off 20% of its workforce in August 2023, just after its bid to raise INR 220 Cr from foreign VCs failed due to potential regulatory hurdles.

Soon after, Kenko Health raised INR 10 Cr in venture debt from Blacksoil per regulatory filings. And then in January and February this year, existing investors — Waveform, Peak XV, Orios, Beenext, and 9 Unicorns — infused INR 12 Cr in the company as a bridge round, show the company’s filings with the Ministry of Corporate Affairs.

Without the insurance license, Kenko’s future rests on how sustainably it can scale up its health plan subscription play if it chooses to stay operational.

Sources indicate that another round of layoffs is underway at Kenko. This is because Kenko has to save costs to repay debt obligations, pending employee costs, and other operational expenses for its current business in FY24.

Employees have taken to LinkedIn to raise concerns about unpaid dues after being laid off in April 2024. Customers claim the company has withheld reimbursements for OPD costs incurred while their plans were active.

Kenko did not answer our questions about these dues to customers or former employees.

Kenko Health Corporate Network

Conclusion

Kenko was close to bringing in a new domestic investor as a lead shareholder to get an insurance license. Still, this deal’s extent of equity dilution has alarmed some existing investors.

The Peak XV-backed startup is staring at an uncertain future and a potential shutdown over this deadlock and has even laid off more employees in 2024 after already cutting costs last year.

Founders Aniruddha Sen and Dhiraj Goel have decades-long experience in the insurance space, but Kenko Health’s insurance goal is becoming more and more out of reach.